Changing Kids’ Lives Through Financial Education

Welcome to the 2022 second quarter RMJ Foundation Newsletter

FINANCIAL EDUCATION

With financial education not being an educational requirement for high schools in most states, and credit unions looking for different ways to education today’s youth, participation in Bite of Reality fairs continues to grow. From January to June of 2022 there have been 227 fairs reaching more than 23,000 students! If you are interested in learning more about bringing the program to your community or would like a refresher on facilitating an in-person fair, contact Jenn Lucas at [email protected].

FINANCIAL EDUCATION

With financial education not being an educational requirement for high schools in most states, and credit unions looking for different ways to education today’s youth, participation in Bite of Reality fairs continues to grow. From January to June of 2022 there have been 227 fairs reaching more than 23,000 students! If you are interested in learning more about bringing the program to your community or would like a refresher on facilitating an in-person fair, contact Jenn Lucas at [email protected].

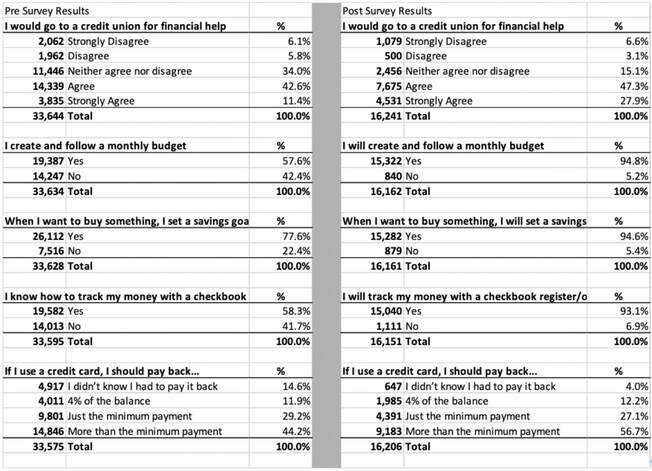

Bite of Reality ® App Data Results

The Bite of Reality app requires all participants to answer five questions at the beginning and end of the simulation. This data allows us to see if there was any growth in knowledge or a possible change in the way they will handle financial decisions after completing the simulation. Here are some of the data collected from fairs conducted from October 2021 through June 2022.

The Bite of Reality app requires all participants to answer five questions at the beginning and end of the simulation. This data allows us to see if there was any growth in knowledge or a possible change in the way they will handle financial decisions after completing the simulation. Here are some of the data collected from fairs conducted from October 2021 through June 2022.

A note about the data – the pre-survey data includes everyone who downloaded the app and answered the first set of questions. Due to data connection issues, as well as some students not fully completing the exercise in the time allotted, the number of students who answer the post-survey questions is generally quite lower.

We are especially pleased to see that prior to a fair, only about half of students say they follow a budget and, after completing the fair, a full 95% say they intend to create and follow a monthly budget. Further, prior to the fair, approximately half of students say they would go to a credit union for help; upon completing the fair, that number jumps up to 75%.

We are especially pleased to see that prior to a fair, only about half of students say they follow a budget and, after completing the fair, a full 95% say they intend to create and follow a monthly budget. Further, prior to the fair, approximately half of students say they would go to a credit union for help; upon completing the fair, that number jumps up to 75%.

BIZ Kid$ Showcase

The National Credit Union Foundation has made some changes to its Biz Kid$ Showcase, which will launch

on September 19 and run through October 28. This is an opportunity for teens to show off their entrepreneurial skills and have the chance to earn cash prizes! Participants will complete a series of modules, build a business plan around their business idea, and help financial wellbeing in their communities. Keep your eye out for more information.

The National Credit Union Foundation has made some changes to its Biz Kid$ Showcase, which will launch

on September 19 and run through October 28. This is an opportunity for teens to show off their entrepreneurial skills and have the chance to earn cash prizes! Participants will complete a series of modules, build a business plan around their business idea, and help financial wellbeing in their communities. Keep your eye out for more information.

FUNDRAISING

All funds raised from our fundraising events allow us to continue to help credit unions bring financial education to their communities and continue to offer our signature Bite of Reality® program for free to credit unions in California and Nevada.

RMJ / Origence Golf Tournament

RMJ / Origence Golf Classic will be held on August 1, 2022, in Dana Point, CA. We currently have 97 golfers registered to play and are hoping you will join them and help RMJ to support financial education. Register Today! www.golfgenius.com

Thank you to our sponsors and all other sponsoring participants:

|

American Share Insurance (ASI) Cal Com CU California and Nevada Credit Union Leagues California CU Corporate America CU CU Leasing of America (CULA) Eagle CU Educational Employees CU (EECU) Foothill FCU Integrated Builders JMFA |

Kinecta FCU Moore, Brewer & Wolfe Newcleus CU Advisors POPA FCU SHAZAM Singerlewak Southland CU Silver State Schools CU Strategic Resource Management (SRM) Thinkwise CU Water and Power Community CU |

RMJ Silent Auction at REACH

RMJ will be holding our annual silent auction during the California and Nevada Credit Union Leagues REACH

conference November 1 – 4. Sponsors in the Exhibit Hall will have the opportunity to participate and help drive

traffic to their booth by donating an item between $75 – $500 in value to be auctioned off at their booth. To learn

more about the RMJ Silent Auction or to donate an item, please contact Jenn Lucas at [email protected]

RMJ Credit Union Train at The Garden Railroad

Thank you to all our sponsors, CO-OP Solutions, LA Financial CU, Logix CU, Origence, SCE FCU, SchoolsFirst FCU, Water and Power Community CU and participating credit unions and business partners CalCom FCU, Credit Union of Southern California, Desert Valleys FCU, Downey FCU, Foothill CU, Jacom CU, Mattel CU, Nikkei CU, Orange County's CU, PacTrans FCU, PostCity FCU, TWHC, Wescom CU. The 2022 Credit Union Train fundraiser was a success and raised more than $9,000 to help support financial education.

RMJ Credit Union Train at The Garden Railroad

Thank you to all our sponsors, CO-OP Solutions, LA Financial CU, Logix CU, Origence, SCE FCU, SchoolsFirst FCU, Water and Power Community CU and participating credit unions and business partners CalCom FCU, Credit Union of Southern California, Desert Valleys FCU, Downey FCU, Foothill CU, Jacom CU, Mattel CU, Nikkei CU, Orange County's CU, PacTrans FCU, PostCity FCU, TWHC, Wescom CU. The 2022 Credit Union Train fundraiser was a success and raised more than $9,000 to help support financial education.

RMJ OUT & ABOUT

Southern Nevada Chapter

On July 15th, RMJ attended the Southern Nevada Chapter virtual / in person panel event that was focused on the purpose of the credit union movement. Matt Kershaw with Clark County CU, Sue Longson with Boulder Dam CU, Scott Arkills with Silver States Schools CU, and Jennifer Oliver with SCE FCU were the panel guests for the evening. They shared their paths to their current positions and how they infuse the CU philosophy within their credit unions. They also shared the importance of employee growth and development as well as how they adapt to changing times and growth in technology and the way we use it. All proceeds from this event benefited the RMJ Foundation.

On July 15th, RMJ attended the Southern Nevada Chapter virtual / in person panel event that was focused on the purpose of the credit union movement. Matt Kershaw with Clark County CU, Sue Longson with Boulder Dam CU, Scott Arkills with Silver States Schools CU, and Jennifer Oliver with SCE FCU were the panel guests for the evening. They shared their paths to their current positions and how they infuse the CU philosophy within their credit unions. They also shared the importance of employee growth and development as well as how they adapt to changing times and growth in technology and the way we use it. All proceeds from this event benefited the RMJ Foundation.

Western CUNA Management School (WCMS)

WCMS in back in session from July 10 – 22 in Claremont, CA. WCMS helps credit union professionals prepare themselves to keep pace with a rapidly changing business environment. The school is designed for managers and upper-level operational staff who have set credit union management as their career goal and understand the need to keep abreast of developments in our industry. Tena was honored to serve as an observer as Year 3 students made their project presentations.

WCMS in back in session from July 10 – 22 in Claremont, CA. WCMS helps credit union professionals prepare themselves to keep pace with a rapidly changing business environment. The school is designed for managers and upper-level operational staff who have set credit union management as their career goal and understand the need to keep abreast of developments in our industry. Tena was honored to serve as an observer as Year 3 students made their project presentations.

Shapiro Summit

The RMJ Foundation will attend this year’s California and Nevada Credit Union League’s Shapiro Summit Conference. The conference will be held on August 19-20 in Anaheim, CA. To register visit Shapiro Summit 2022

The RMJ Foundation will attend this year’s California and Nevada Credit Union League’s Shapiro Summit Conference. The conference will be held on August 19-20 in Anaheim, CA. To register visit Shapiro Summit 2022