Changing Kids’ Lives Through Financial Education

2020 YEAR END WRAP UP

Welcome to the RMJ Foundation Newsletter

|

2020 was a historic year. It was one that will be etched in our minds, shaping our world for years to come. Despite all the challenges, your resilience and dedication helped us continue to bring financial education to today’s youth! As a new year begins, we would like to say thank you for all that you do. Your continued support during these times is invaluable to RMJ, and we are excited to see what we can accomplish together in 2021. |

Contributions and Fundraising

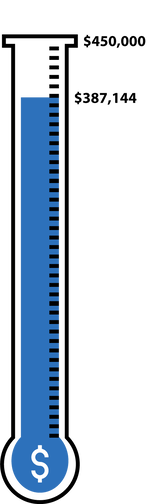

Due to all the great support and generosity the RMJ Foundation has received throughout 2020, we were able to have a successful year with fundraising and were able to come close to our fundraising goal of $450,000.

In October and November, The RMJ Foundation held a silent auction in conjunction with the California and Nevada Credit Union Leagues’ virtual Shapiro Summit and REACH conferences. There was no shortage of support from attendees and booth sponsors. We had a few friendly bidding wars, and the two auctions combined brought in more than $5,000 for the Foundation. Thank you to all the Exhibit Hall sponsors that participated and donated an item to the auction. And thank you to everyone who bid on items.

Due to all the great support and generosity the RMJ Foundation has received throughout 2020, we were able to have a successful year with fundraising and were able to come close to our fundraising goal of $450,000.

In October and November, The RMJ Foundation held a silent auction in conjunction with the California and Nevada Credit Union Leagues’ virtual Shapiro Summit and REACH conferences. There was no shortage of support from attendees and booth sponsors. We had a few friendly bidding wars, and the two auctions combined brought in more than $5,000 for the Foundation. Thank you to all the Exhibit Hall sponsors that participated and donated an item to the auction. And thank you to everyone who bid on items.

|

BizKid$

In 2021 RMJ will continue providing grants for credit unions to purchase the BizKid$ 6 season box sets on DVD or season 1-3 and 6 are available for download. If you are interested in learning more, please visit rmjfoundation.org or email [email protected]. The RMJ Foundation is working with other state credit union foundations nationwide to potentially launch a Bizkid$ contest. Participants in each state will have a chance to win cash prizes for their business creations. This project is still in the early stages, but we’ll let you know when there’s more information. |

|

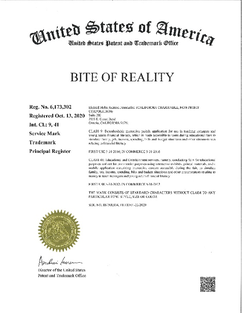

Bite of Reality® Trademark

In November 2020 we received our official trademark for Bite of Reality®. This gives the RMJ Foundation and the credit unions that use our program protection from anyone else using this name for reality fairs – setting credit unions apart in the financial education arena. We are excited to have completed this process and have the trademark in hand. |

Bite of Reality®

We created a remote version of the Bite of Reality® App to allow credit unions to deliver the program more easily in a distance-learning setting. We also added new Fickle Finger of Fate events and updated some of the occupations. There was also a credit score added to the app for each persona. Credit scores are assigned randomly, and a low credit score will affect a participant’s ability to buy a house and charges additions fees when buying a car.

The remote version of Bite of Reality® is still available nationwide. There is no current scheduled date to discontinue the remote version; we will continue to offer the remote version until in-person fairs can once again take place.

In 2020 we had 86 in-person Bite of Reality® fairs from January to March, reaching 12,660 students. From April to December, we had 90 virtual Bite of Reality® fairs, reaching 1,958 students nationwide through the remote version of Bite of Reality®. Thank you to all the credit union foundations and credit unions that have brought Bite of Reality® to your communities and helped to reach a total of 14,618 students in 2020.

We created a remote version of the Bite of Reality® App to allow credit unions to deliver the program more easily in a distance-learning setting. We also added new Fickle Finger of Fate events and updated some of the occupations. There was also a credit score added to the app for each persona. Credit scores are assigned randomly, and a low credit score will affect a participant’s ability to buy a house and charges additions fees when buying a car.

The remote version of Bite of Reality® is still available nationwide. There is no current scheduled date to discontinue the remote version; we will continue to offer the remote version until in-person fairs can once again take place.

In 2020 we had 86 in-person Bite of Reality® fairs from January to March, reaching 12,660 students. From April to December, we had 90 virtual Bite of Reality® fairs, reaching 1,958 students nationwide through the remote version of Bite of Reality®. Thank you to all the credit union foundations and credit unions that have brought Bite of Reality® to your communities and helped to reach a total of 14,618 students in 2020.

Other News

2021 Foundation Celebration Spotlight Past Wegner Award Winners

The National Credit Union Foundation (the Foundation) is excited to announce that sponsorship and viewing packages are available for purchase for the 2021 Foundation Celebration, a virtual event spotlighting past Wegner Award winners. The Foundation will not be presenting the annual Herb Wegner Memorial Awards in 2021 and want to honor new winners as they should be, in person with family and friends. This year bringing the spirit and inspiration of the Wegner Dinner into your organization and home through the Foundation Celebration! The Foundation Celebration provides a fun “night out” for our movement to get dressed up, experience interviews with some of our favorite past Wegner Award winners with help from emcee Andy Janning, support the National Credit Union Foundation and an opportunity to get re-energized with passion for the difference we make as credit unions. Click here to register for this event.

2021 Foundation Celebration Spotlight Past Wegner Award Winners

The National Credit Union Foundation (the Foundation) is excited to announce that sponsorship and viewing packages are available for purchase for the 2021 Foundation Celebration, a virtual event spotlighting past Wegner Award winners. The Foundation will not be presenting the annual Herb Wegner Memorial Awards in 2021 and want to honor new winners as they should be, in person with family and friends. This year bringing the spirit and inspiration of the Wegner Dinner into your organization and home through the Foundation Celebration! The Foundation Celebration provides a fun “night out” for our movement to get dressed up, experience interviews with some of our favorite past Wegner Award winners with help from emcee Andy Janning, support the National Credit Union Foundation and an opportunity to get re-energized with passion for the difference we make as credit unions. Click here to register for this event.

Shapiro Summit: This year, RMJ will be attending the California and Nevada Credit Union Leagues Shapiro Summit Conference on September 30 to October 1. We are looking forward to hearing all the great speakers lined up and to have the chance to engage with other attendees. We will be holding a Silent Auction in the Exhibit Hall during the conference. Click here for a preview of the auction items. Thank you to Origence, CU*NorthWest, Alliance Reverse Mortgage CUNA Mutual Group and Catalyst and for donating items for this auction.

Financial Corner–Brought to you by PSCU

PSCU’s Eye on Payments 2020 study reveals that Generation Z, the youngest generation of adult consumers, indicates a strong preference for debit. In fact, Gen Z is the demographic that most prefers debit cards, with 44% of survey respondents aged 18-22 selecting debit as their first preferred payment method, up from 39% in 2019. This up-and-coming generation of consumers also reported strong contactless card usage prior to COVID-19, and that number has only increased since the pandemic: Nearly three-quarters (74%) of Gen Z respondents say they have used their contactless card at least a few times per month during COVID-19, and they expect that usage to hold steady.

This generation has experienced the most negative financial effects of COVID-19, with 67% indicating a loss of job, income, or healthcare coverage. Although they are just starting out, consumers in this generation have already had time to develop viewpoints on credit unions, and most agree that credit unions are good places to get advice and guidance on financial matters. This sentiment, combined with the level of financial anxiety this generation is facing, offers credit unions the opportunity to build strong relationships with Gen Z consumers.

Want to learn more? Download PSCU’s Eye on Payments 2020 study today

PSCU’s Eye on Payments 2020 study reveals that Generation Z, the youngest generation of adult consumers, indicates a strong preference for debit. In fact, Gen Z is the demographic that most prefers debit cards, with 44% of survey respondents aged 18-22 selecting debit as their first preferred payment method, up from 39% in 2019. This up-and-coming generation of consumers also reported strong contactless card usage prior to COVID-19, and that number has only increased since the pandemic: Nearly three-quarters (74%) of Gen Z respondents say they have used their contactless card at least a few times per month during COVID-19, and they expect that usage to hold steady.

This generation has experienced the most negative financial effects of COVID-19, with 67% indicating a loss of job, income, or healthcare coverage. Although they are just starting out, consumers in this generation have already had time to develop viewpoints on credit unions, and most agree that credit unions are good places to get advice and guidance on financial matters. This sentiment, combined with the level of financial anxiety this generation is facing, offers credit unions the opportunity to build strong relationships with Gen Z consumers.

Want to learn more? Download PSCU’s Eye on Payments 2020 study today